Dementia doesn’t just steal memories—it can unravel a family’s sense of control.

If you’re scrambling to figure out how to protect a loved one’s wishes while managing doctor appointments and mood swings, you’re not alone.

Let’s cut through the chaos with actionable legal planning advice for families with dementia.

“What If They Can’t Make Decisions Anymore?”: Start Here

Imagine your mom forgets to pay bills, or your dad wanders off because he doesn’t recognize home. Dementia may turn simple tasks into minefields.

The antidote?

Plan ahead. Legal planning isn’t about pessimism—it’s about giving your family a flashlight in the dark.

Key stats to know:

- Over 50% of people with dementia haven’t documented their care preferences.

- 1 in 3 adults over 65 dies with Alzheimer’s or another dementia.

The Legal Tools You Can’t Afford to Ignore

Think of these documents as your “emergency kit” for dementia care.

Durable Power of Attorney: Your Financial Guardian Angel

A durable power of attorney lets your loved one handpick someone to manage money, property, and bills when they’re no longer able.

Without it? You’ll need court approval to access their accounts—a slow, expensive process.

Why it’s non-negotiable:

- Prevents scams (dementia patients are 300% more likely to be financially exploited).

- Lets you sell assets to fund care (like moving to assisted living).

Pro tip: Update this ASAP after a dementia diagnosis. Legal capacity—the ability to understand the document—can fade fast.

Healthcare Proxy + Advance Directive: The Voice When Words Fail

A power of attorney for health care (aka healthcare proxy) appoints someone to make medical calls. Pair it with an advance directive to spell out wishes for:

- Life support

- Feeding tubes

- Pain management

Fun fact: Only 37% of adults have an advance directive. Don’t let your family guess what “doing everything” means.

Script for tough talks:

“Mom, if you couldn’t speak for yourself, would you want us to prioritize comfort over aggressive treatments?”

Wills and Trusts: Keeping the Peace After They’re Gone

A living trust bypasses probate (the court process that takes 6–18 months). It’s like a treasure map for your inheritance—clear, specific, and conflict-proof.

When to use a trust:

- If they own property in multiple states.

- To provide for a child with special needs.

The Guardianship Gauntlet: When All Else Fails

If your loved one didn’t sign a power of attorney before losing legal capacity, you’ll need guardianship. Think of it as asking a judge to appoint you as their decision-maker.

The catch:

- Costs $2,000–5,000+ in legal fees.

- Requires annual court updates.

Avoid this mess: Set up a durable power of attorney now.

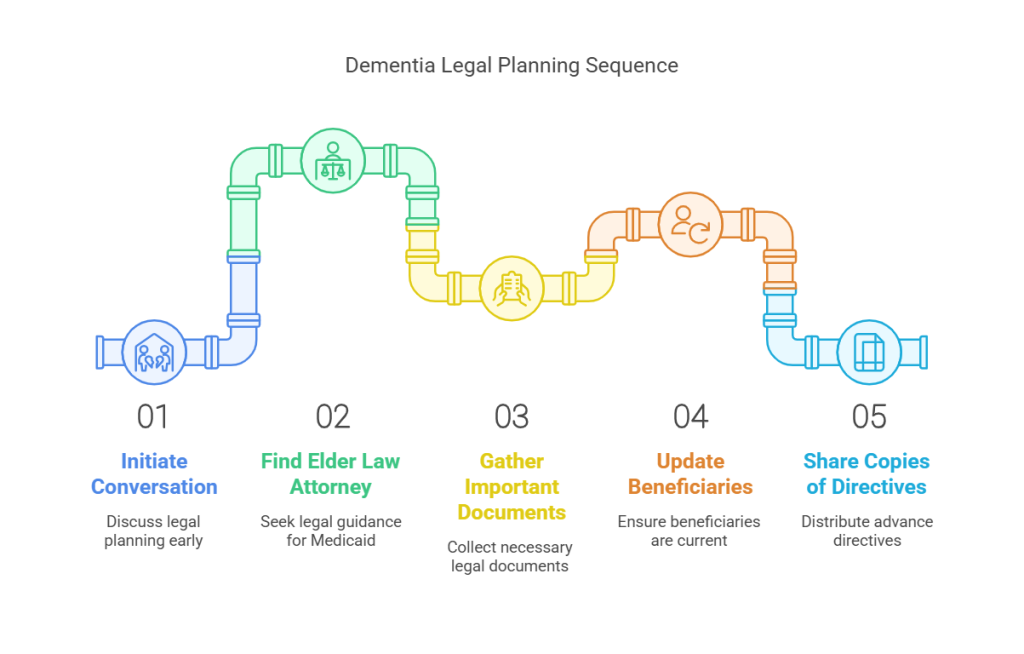

Dementia Legal Planning Checklist

Use this cheat sheet to stay on track:

- Talk early—Have “the conversation” while they can still participate.

- Find an elder law attorney—They’ll navigate Medicaid rules and asset protection.

- Gather docs:

- Will/trust

- Deeds, bank statements

- Insurance policies

- Military records (for VA benefits).

- Update beneficiaries—Retirement accounts override wills!.

- Share copies—Give healthcare providers and family the advance directive.

“But How Do We Pay for All This?”: Long-Term Care Hacks

Memory care costs $5,000–7,000+/month. Ouch. Here’s how to soften the blow:

Medicaid Magic:

- Requires spending down assets first (but a trust can protect your home).

- Apply 3–5 months before needing care—it’s a slow process.

Veterans’ Benefits:

- Aid & Attendance pays up to $2,300/month for in-home care.

Hybrid Strategy:

- Use savings for 2 years of care, then switch to Medicaid.

Elder Abuse: Spot It, Stop It

Dementia makes your loved one a target. Red flags:

- “New friends” asking for money.

- Missing jewelry or cash.

- Unexplained credit card charges.

Defense plan:

- Freeze their credit.

- Set up bank alerts for big withdrawals.

Your Next Step: No More “Someday”

Legal planning for dementia isn’t a luxury—it’s love in action. Start small:

- Call an elder law attorney (many offer free consults).

- Download a free advance directive form (try the Alzheimer’s Association).

- Text your sibling—”Let’s tackle Dad’s paperwork this weekend.”

The fog of dementia is relentless, but your legal plan can be the lighthouse.

Take a breath, make the call, and reclaim your peace of mind.

Because when it comes to legal planning advice for families with dementia, tomorrow is already here.